One has always expected to stumble a little when trying to immerse themselves into financial market analyses, especially through learning by online courses. Whoever uses EDX as a means of resource feels this thrill of tackling the complexities of such a financial world. Sometimes, though, one reaches certain obstacles in the form of “wrong answers,” those pesky little questions that sound so simple or just plain confusing. If you’ve gone through this, know that you’re not alone.

Table of Contents

ToggleWhy EDX Courses on Financial Market Analysis are so Popular

As is common knowledge, the financial market is a different beast altogether: truly understanding how it moves and many trends requires many analyses with a blend of technical know-how and practical experience.

EDX courses are the talk of the town for any enthusiastic learner, be it a fresh graduate or an experienced professional, who just wants to upgrade their learning. The courses are flexible; they review tough material in a manner that feels approachable. In this regard, all that glitters is not gold, as everything has pros and cons with specific cons overshooting the technical questions posed in these courses, such as Financial Market Analysis.

In this section, let’s explore some of the common “wrong answers” that people encounter in EDX’s Financial Analysis courses, what they reveal about our understanding, and how to make the most of these challenges. After all, that journey in trying to get it “right” is where the real learning happens.

What would be considered “wrong answers” in the analysis of a financial market?

It’s ironic, really. The term “wrong answer” is always associated with frustration, especially when one’s goal is to get full marks. However, wrong answers in this case are not misses but mini-guides on where our understanding of the subject may be-at fault. We can look at every misstep as a nudge in the right direction when we take up learning as a journey-an opportunity to re-evaluate assumptions, rethink strategy, and return stronger.

Let’s take a look at each of some of the key areas where learners most frequently confront these “wrong answer” obstacles and how grasping those can deepen one’s knowledge in financial market analysis.

1. Confuse Terms-Concepts

- Challenge: Imagine yourself right in the middle of a quiz, and on comes a ‘term’ that sounded like ‘financial jargon wrapped in a puzzle’. Terms such as “beta coefficient”, “standard deviation”, or even “yield curve” are not exactly easy to decipher with the proper contextualization. No wonder these things make very many people draw a blank; they are subtle and call for firm grounding in financial basics.

- How to overcome it: The best way to tackle tricky terms is to make some kind of a glossary. Each time you notice some new term from the EDX course, write it down; break it down and show real-world examples. For example, beta as a measure of volatility becomes much easier to grasp if you know how to correlate it to your favorite stock or market index. Exactly, and many learners find that the process of ‘actively creating’ examples makes the huge difference.

2. Overthinking analytical questions

- Challenge: The beauty of any financial market analysis is that it incorporates art and science in its meaningful blend. But this can be its drawback, too. Many questions could be hypothetical to make you think about a market trend or the movement of stocks or the effects of an investment. And very often, the answer is simple, much simpler than what we would have thought. But our tendency to overthink the questions certainly complicates things unnecessarily and lands us at an incorrect conclusion.

- How to handle it: Rather than get mired in “what if” scenarios, go back to the fundamentals. Many learners reflect that the basics such as supply and demand, risk versus return, diversification-are designed to keep you prepared for more challenging analytical questions. With practice over time, you get into a rhythm with this kind of question-and stop second-guessing yourself.

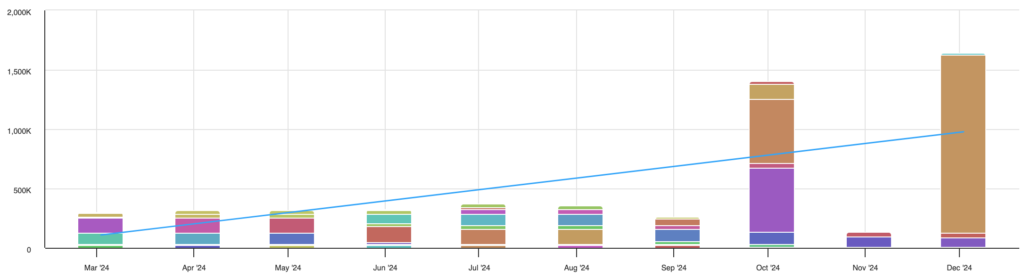

3. Interpretation of graphs and data sets

- The challenge: If there’s one area where wrong answers are almost certain, it’s interpreting data. Financial market analysis courses in EDX often use graphs, data sets, and charts to demonstrate market trend or predict the movement of stocks. That is a powerful way of learning; however, many learners fumble over the subtleties. For instance, identifying a trend or reading a correlation coefficient may not be as simple, especially when a chart includes a number of variables.

- How to overcome it: The best thing is to practice the step-by-step interpretation of data. Take any element in a graph or chart and ask yourself a question, “What does this concrete line or bar represent?” Then add more elements one at a time. And of course, don’t be afraid to seek guidance from outside sources regarding how to interpret information represented in those weird graphs and charts. Others may use financial news websites or stock analysis tools to review real-world examples, making the course material more relatable and functional.

4. Misunderstanding of risk metrics

- Challenge: The metrics of risk, such as VaR, Sharpe Ratio, among others, are intrinsic in financial market analysis. While these metrics are vital for the assessment of investment risks, the formula and ideas that constitute these metrics mostly sound abstract. A number of people respond to questions on such concepts incorrectly because they don’t well understand what each metric is trying to say about an investment’s performance or level of risk.

- How to handle it: A good way to understand risk metrics is to first go for the big picture: What is each metric attempting to tell you? For instance, the Sharpe ratio is a return-risk-adjusted measure on which high numbers are usually good. Once you understand the “why” behind each metric, the math is easier to follow. Try to relate each metric to a real scenario in your life whenever possible, like deciding on a savings plan or considering a job offer where one of the benefits is uncertain. Having a context this way, will make these risk calculations less intimidating.

5. Market Indicators and Their Limitations

- The challenge: Indicators are needed to forecast markets, but they have inherent limitations. For example, the so-called leading indicators can indicate only the direction in which the economy may move. Many of these leading indicators are not good trackers of the overall economy even. You could easily get questions wrong because you overlooked those limitations or misunderstood the indicator.

- How to overcome it: Remember, in order to feel comfortable with market indicators, they are tools and not crystal balls. They may provide insight into something, but they cannot guarantee any outcome. In going through this course, notice which of the indicators come up time and again and see if you can understand the context and purpose. Financial news, market commentary, even podcasts-provide real-world context for these theoretical concepts and help bridge the gap between class learning and on-the-job application.

6. Ignoring external factors that affect markets

- Challenge: In some of those cases, especially courses about financial market analysis here on EDX, rely too much on quantitative data, which is important for correct analysis. But markets depend on so many exogenous variables: geopolitical events, changes in law or regulations, even natural calamities. Very many learners forget these when making their answers to questions, and hence they miss and go to the wrong answer.

- How to approach it: Keep the big picture in mind. Understanding the economic situation and current world events gives a linkage between what’s in these textbooks and what transpires in the market. It’s good that you be aware of news headlines when you study that may underscore the unpredictability of markets. Not only does this give context, but it also allows you to approach each question with a broader scope of knowledge of possible factors affecting.

Turning “Wrong answers” into valuable lessons.

You may become discouraged or frustrated after having given some of these wrong answers yourself. On the other hand, each wrong answer can be an opportunity to enhance your understanding. Learning to take mistakes as a part of improvement is important in mastering financial market analysis. Following are the suggestions as to how you can make the most out of them:

- Accept errors as feedback: Basically, wrong answers should not be perceived as failures, but rather feedback areas that require more attention. Identify the pattern: Are there specific concepts or questions you always get wrong? Use these observations to clearly identify your weak areas and give them extra attention.

- Socialize: Online learners benefit considerably from social contact with their peers. EDX forums, as well as sub-redactions and LinkedIn groups dedicated to financial markets, are ideal grounds to ask questions or view how others interpret challenging material. Many times, hearing how someone else solved a problem that was difficult for you will provide the missing piece and shed light on where there was darkness.

- Active review: One of the most effective study methods involves a regular review of your mistakes. Go back to previous lessons, reread the explanations, and try to do similar questions. The more you revisit these weak areas, the more comfortable they will become in time.

Why Financial Market Analysis EDX Wrong Answers Are Worth an Effort

Every problem in financial market analysis is an opportunity to gain confidence and understanding. Obviously, market analysis skills cannot be developed overnight, but over time, question by question, mistake by mistake. Perhaps the most important value of EDX courses is that they let us struggle through these wrong answers and succeed. You will see financial market analysis to be mainly easier to handle and even enjoyable by considering these mistakes as stepping stones, not obstacles.

Your future self will thank you-be it in a finance career, in investing, or just in being versed in the markets as a consumer-for the hard-won wisdom those wrong answers earned.

Get expert tips and financial guidance at LookMyFinance.com.