Table of Contents

Toggle1. Why Kia Motors Finance is the Key to Driving Smarter

Owning a car should be exciting, not stressful. Kia Motor Finance takes that stress away from the equation, allowing flexible and convenient financing to suit your needs. Whether you’re buying for the first time or are just upsizing, this program ensures that everything from beginning to end is seamless.

At Kia Motor Finance, lending is not just about creating a complete, all-around financial experience. From competitive interest rates to exclusive loyalty rewards for return customers, Kia’s financing arm considers the needs of its clients while creating its programs. Secondly, Kia’s system is simple and easy to work with, providing clarity with each step so you can feel empowered with your money.

Another standout benefit is the level of accessibility they provide. Thanks to tools like the Kia Motors Finance Company Login, you can access your account anytime and from any location. Whether you need to check a balance or schedule a payment, you’re never more than a few clicks away from staying on top of things.

This convenience and personalization are what Kia stands for among any competitors. You are not just taking a loan for the car, you are getting yourself associated with a brand that is committed to standing by your journey on the road.

2. What is Kia Motors Finance?

Kia Finance is the financial services arm of Kia responsible for making car ownership easy for its customers, be it financing in whatever form is demanded by diverse needs or ensuring that every person gets a shot at owning a car. Whether you are looking for a short-term lease or a long-term finance facility, Kia Motors Finance has the solution.

And that’s only the tip of the iceberg, as this goes a long way past the loan itself. Take the Kia Motors Finance Company Login, for example. The customer has a number of tools online. For example, electronic statements, setting up auto-pay, and learning about account activity. That’s right, folks; to handle your car loan with your computer, all you need do is come on in.

Moreover, Kia Motors Finance is determined to educate its clients. They have on board various forms of literature to help one comprehend his or her options as far as payment is concerned, what the interest rates are, and even give some tips on maintaining a credit score. This holistic approach aims at ensuring that you are not just financing a car but are gaining financial insights to benefit you in other areas of life.

Of course, with this comes ‘special offers and seasonal promotions’ provided by Kia Motors Finance, making Kias more affordable for people. This naturally reinforces Kia Motors Finance’s mission of making car ownership a reality for all.

3. Kia Motor Finance Login Access

Step-by-Step Guide to Login

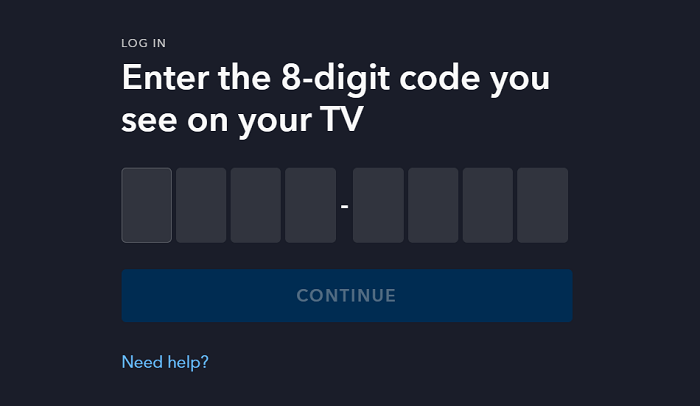

Logging in to Kia Motor Finance is a powerful tool for car financing management. You can log in with desktops and mobile devices to securely keep track of your payments and accounts.

- Log in on the official Kia Motor Finance website.

- Click the “Log in” button at the top right of the home page.

- Enter your username and password. If you are a first-time user, please select “Register Now” to create an account.

- Once logged in, you will have access to your payment history, payoff details, and account settings.

The login portal is user-friendly. You can set up autopay so you will never have to pay late, update your personal information, and even see some promotional offers. Using the “Forgot Password” link will make resetting your password quick and easy if you forget it.

The Kia Motor Finance phone number aids those who would not want to take an online approach in managing accounts. From the most frequent questions—like due dates of payments—to technical issues with the login portal, they can assist in any issue at hand.

With Kia Motor Finance, managing your account is easy and secure—so you can focus on what counts: enjoying your Kia.

4. Why Online Account Management Changes the Game

Moving with the times, the digital age has redefined how we approach finance, and Kia Motors Finance does no different with a quite intuitive online portal. More than just a website, the Kia Motors Finance Company Login is your financial hub for anything to do with your car loan from Kia.

Think of heading on vacation and suddenly remembering that a car payment is due. You don’t have to panic; simply log in via your smartphone account, schedule the payment, and go back to enjoying yourself. This is the kind of freedom Kia’s online tools have provided.

Beyond that convenience, transparency is available within the platform: it’s easy to see how much was paid and when, what the outstanding balance currently is, and even the capability to calculate payoff amounts in real-time. You will also be able to update your preferences, edit payment methods, and update your contact information if needed.

Further, making it more convenient for customers who would rather automate, the portal allows you to set up recurring payments. It will guarantee you will never miss a due date, helping you evade late charges and displaying a better credit score. If questions arise, contact the Kia Motor Finance phone number for support.

With these features, Kia Motors Finance shows that managing your car loan doesn’t have to be a hassle. It is easy, safe, and oriented toward the modern customer.

5. Kia Motor Finance – Phone Number is Important

Friendly as a digital system may be, there are just those times when one needs a voice on the other end of the line. The Kia Motor Finance phone number is your direct connection to professional support so all of your questions can be answered in the timeliest manner possible.

Whether you are calling to express your concern about a missed payment, any misunderstanding regarding your account, or having technical difficulties with the login portal, be assured that the customer service team will be there to assist you. They are trained to quickly resolve any issue to ensure your experience is not disrupted.

On the other hand, the telephone line is a good avenue through which to inquire about new financing possibilities or to gain an understanding of promotional offers. For instance, if you want to refinance your loan or even make the switch to a newer model of Kia, representatives can guide you through it.

Knowledgeable support translates to Kia’s commitment to satisfied customers. They realize that every driver’s situation is different, and they’re committed to finding solutions that’ll work for you.

6. Payment Plans Designed to Fit Any Budget

No two drivers are alike, and Kia Motor Finance knows this more than anyone. That’s why they offer a range of payment plans to suit different financial situations.

- If you are the type of person who enjoys driving new models, you might want to consider a short-term lease. Generally, leases often have lower monthly payments, and after a few years, you will be able to upgrade to another new car.

- If you would prefer stability over the longer term, though, traditional financing does have the advantage of full ownership when you’ve paid for the loan.

Additionally, Kia Motor Finance provides deferred payments, especially during difficult times. You can log in to your Kia Motors Finance Login and ask for a payment extension or another type of accommodation to help you stay on track.

It’s their stated mission to make owning that car as accessible and hassle-free as possible, regardless of your budget or situation.

7. How Kia Motors Finance Supports Sustainable Driving

As the automotive industry moves to become “green,” Kia is at the front line, offering greener machines. Complementarily, Kia Motors Finance offers special financing for models like the Kia EV6 and Niro EV.

- These plans include a lower interest rate or other incentives for choosing an electric or hybrid vehicle.

- It definitely will be a win-win situation: you will be reducing carbon emissions while enjoying some very sweet financial incentives.

- In addition, Kia has added educational resources on the long-term cost savings you can realize with an electric vehicle, from lower fuel costs to possible tax credits.

At Kia Motors Finance, sustainability isn’t a choice; it’s an investment in a better future.

8. Common Questions Answered About Kia Motor Finance

How do I reach Kia Motor Finance support?

Your best tool for quick assistance would be the Kia Motor Finance phone number. From addressing any issue with payment to asking about promotions, they are ready to help.

What if I miss a payment?

Life finds a way, and Kia knows that. Log in to your account to review options for payment assistance or to establish a revised payment arrangement.

Is refinancing available for my loan?

Yes, Kia Motors Finance provides refinancing options to capture better rates or adjust month-to-month payments.

9. How to Get the Best Out of Kia Motor Finance

Leverage Promotional Offers

Check the latest offers from time to time by logging onto your Kia Motors Finance Login. The seasonal offer can be in various forms, such as a low rate of interest or no down payment.

Automatic Payment Setup

We encourage all clients to make life easier by enabling autopay through their account portal. It’s a small step that could make a world of difference, and you’ll avoid late fees.

Follow these tips, and you will get the full benefits from Kia Motor Finance to make owning a car smooth and rewarding.

Get expert tips and financial guidance at LookMyFinance.com.