When people refer to financial growth, talks of stocks dominate. However, there is one complementary indispensable tool that most investors often overlook: bonds. These are not for the ultra-conservative investor or the retiree; they can be an integral and effective addition to any financial portfolio. From the small investor to the big investor, bonds offer unique advantages that help stabilize income and growth. Let’s decompose the very bonds, the way they work, and the potential benefits they hold in helping an individual reach his or her financial goals.

Table of Contents

ToggleBonds What is it? How Does it Work?

At first sight, I myself would say it looks well intricate; however, basic fundas are quite simple for nature. Essentially, lends money to an organization; governments as well as corporations’ and municipalities’. Of course, when you advance monies, you generate it for some period over which you get your principal once and over that bond reaches your age.

Types of Bonds

Every bond has its characteristics as well as advantages. Let me give you a summary:

- Government Bonds: They include government bonds, which represent quite safe investments because they have the backing of national governments. Treasury bonds are perhaps one of the most well-known forms in the U.S.

- Corporate Bonds: They are issued by companies that want to raise funds for specific projects or operations. In general, they carry a slightly higher risk but usually give a better interest rate.

- Municipal Bonds: Typically issued by a local government or municipality, these are basically applied for public project funding purposes. One of the most interesting facts about some of them is their tax exemption, depending on the locality.

- Savings Bonds: They are specifically designed for individuals and are known to be safe investments, though a bit lower in yields compared with corporate and government bonds.

Why are bonds important in financial development?

Investors often forget how much bonds can benefit a portfolio, but these instruments can add stability and income, protecting them against various falls. Here are a few reasons why bonds are essential for financial growth:

1. Stable Income

Because bonds pay regular interest, the income stream is predictable. This predictability makes it easier to plan for living expenses, reinvest money into other assets, or know that every quarter or so, money will be coming in.

2. Diversification and Risk Management

Adding bonds to your portfolio has the effect of diversification. Stocks can move rapidly in one direction, while the return on bonds tends to be more stable. By mixing stocks and bonds, you are minimizing total portfolio volatility, particularly if you’re experiencing an unpredictable market.

3. Capital Protection

Many bonds return your full principal at maturity. Bonds are what would work perfectly for an investor who wants to safeguard their investments but still generate some return.

4. Inflation Protection with Certain Bonds

In others, for example, Treasury Inflation-Protected Securities or TIPS, inflation may help to increase the purchasing power of your money over the lifetime of the bond.

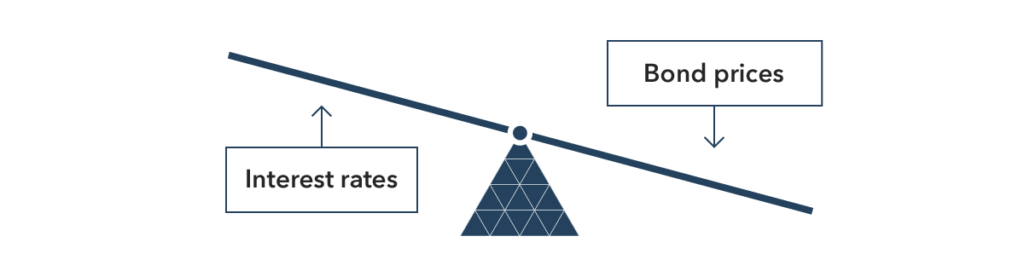

Understanding The Yields On Bonds And Interest Rates

Bond yields and interest rates go together. If you want to maximize return, then it is essential to understand the relationship between these factors of influence. The bond prices will typically fall if the interest rate goes higher and vice versa. That’s because, when an interest rate increases, new bond issues yield a better return compared to old lower-yielding bonds.

Managing Bonds in an Increasing Interest Rate Environment Tips:

1. Consider shorter-term bonds.

Short-term bonds are less responsive to interest rate change; therefore, they can resist the increasing rate pressures much better.

2. Laddering

The process of bond laddering involves buying a series of bonds that mature at different times, enabling periodic reinvestment. This has served well in a rising rate environment as well as in the case of falling rates.

The Hidden Benefits: How Bonds Contribute to the Long-Term View by Adding Balance to a Portfolio

Yes, many investors like high-growth stocks, but bonds can be quite useful silently helping a long-term goal with stability and even compounding returns.

1. Peace of Mind in Unpredictable Markets

When markets are unstable, bonds stand the test of time. They can be that safety net one needs for people near retirement or those looking for some stability in returns.

2. Tax Benefits with Specific Bonds

In particular, municipal bonds provide tax-free income, which is valuable in high-tax states, and tax-exempt status can enhance your after-tax return, based on your income level.

3. Portfolio growth potential

Bonds may not let your money grow explosively like equities, but they will add a layer of growth to the portfolio in slow motion. Reinvestment of interest payments from bonds can slowly contribute to your wealth, without the volatile effects other investments entail.

Pricing: Adding Bonds to Your Portfolio

Ready finally to get bonds into your financial plan? Here’s how.

1. Define your goals and timeline

Are you looking for income, stability, or long-term growth? Knowing any one of these will already help you make the appropriate kind of bond investment decision. Maybe younger and more risk-tolerant investors want to go for more corporate bonds for better returns. Maybe those who are nearing retirement want to avoid risks and invest in government bonds for safety.

2. Determine Your Risk Tolerance

The risks are never equal to the bonds. Corporate bonds hold the highest possible return, with gigantic risks involved. On the other hand, government and municipal bonds are very safe but offer only moderate returns.

3. Consider Bond Funds or ETFs

These can be good options for diversified building because bond funds or ETFs pool a collection of bonds for broader exposure to a market and professional management.

4. Ladder your bond investments

This you do by creating a bond ladder, and spacing out maturity dates to take advantage of changes in interest rates over time.

5. Rebalance Annually

As with any portion of a financial plan, bonds need to be monitored and adjusted over time. Changes in interest rates, the economy, or your life can all affect your bond portfolio.

Bonds vs Stocks: Which is Better for Financial Growth?

Many investors are really puzzled and wonder whether they should invest only in stocks, only in bonds, or in some mix of the two. The answer all depends on one’s personal goals, risk tolerance, and market outlook.

1. Growth potential

Stocks typically have more growth potential, but they also tend to be more volatile. Bonds do offer a steady return that can be quite enticing for those who avoid ups and downs within the market.

2. Risk Management

Bonds are a hedge in a portfolio, especially in a down market. Stocks can grow significant wealth over a long period, with much more volatility.

3. Income generation

Bonds are pretty good when one is considering regular income generation; stocks can pay dividends, but not with the predictability of bond interest.

How bonds can improve financial growth from one stage of life to Another

Whether an individual is just starting to invest or is close to retirement, bonds could play a part in financial growth. This is how bonds could fit into different life stages:

Young investors

Less attractive to younger investors focused on growth may be bonds. However, the addition of even a small percentage of bonds creates a balance in a portfolio and reduces its overall volatility.

Mid-career investors

The thing that would be prudent to do at this point, though, is balance it out. The bonds will generate income and stabilize things while financial goals are being ironed out.

Before retirement

Converse to that approach is the individual who is near retirement age, whereby capital protection becomes vital. Bonds are secure and can protect one’s wealth while generating income.

Retirement

Bonds offer retirees predictable, income now without the volatility of stocks. Bonds can be especially valuable for preserving the capital that allows a comfortable lifestyle in retirement.

Conclusion (Bonds in Financial Growth)

Besides serving as a refuge of safety and security for cautious investors, it is an essential tool for any serious investor who has a prejudice for financial growth. By lessening the mystery of how bonds work and incorporating them into your portfolio, you will build a solid foundation with a balance between growth and stability in view. Whether it’s the steady income via regular interest payments, portfolio diversification, or capital preservation, bonds offer several benefits making them valuable in any investment strategy.

Get expert tips and financial guidance at LookMyFinance.com