Regarding money management, finding clarity from resources that help you make sense of challenging financial ideas is a godsend. Focused Wealth Management Videos provide clarification; the concept of money management is broken down into understandable, actionable content. In this blog, let’s find out why these videos are trending, how they can help with different financial needs, and what’s even more important they will make your money management process less overwhelming. Now we will see what such videos cover, who they are, and how they will help to make more confident financial decisions.

Table of Contents

ToggleWhat are focused money management videos?

Focused money management videos are curated to provide specific areas of personal finance that are important for managing one’s wealth and growing or protecting it. Areas generally covered under focused money management videos usually include investment strategies, retirement planning, some points on tax-saving tips, and estate planning. The aim here is to show the viewer a lot of crystal-clear information without using concrete abstracted financial terminology, therefore bringing money management more within reach to any inexperienced or well-seasoned investor.

Why video content on money management?

Let’s face it, generic advice on finance is invariably confusing and overwhelming. Video content bridges this chasm by offering insight in a manner that’s so much easier to grasp and follow: watch a step-by-step guide to set up a retirement fund or compare various investment options for clarity and confidence. These videos hence use plenty of visual aids such as charts, graphs, and real-life examples to make such complex ideas more absorbable and relate to the viewer’s finances.

Key Topics Covered in Focused Wealth Management Videos

These videos cover some important topics. Here’s what you can find and how each topic may support your financial goals:

1. Investment Strategies

From ‘Stock Market Basics’ to ‘How to Understand Bonds and Mutual Funds’, the videos introduce the viewers to all basic concepts in investing. Oftentimes, they include topics of risk management, asset allocation, or how to balance a portfolio based on personal goals and finances. For the investor who is just starting to invest, this can be an appealing way to be introduced to such a complicated subject.

2. Retirement Planning

Retirement savings are intimidating stuff. The videos on the subject explain options such as IRAs, 401(k) plans, or some other retirement accounts; they list the advantages and disadvantages of each. The videos then guide the viewer through establishing a timeline of how saving a little bit each month can build a more secure future.

3. Tax-Efficient Strategies

Taxes are a big part of any financial plan, and legally minimizing those can have a long-lasting effect on one’s wealth. Videos on the topic explain deductions, credits, ways to reduce taxable income, and even certain investments, such as Roth IRAs, that may provide long-term benefits by offering tax advantages that match with goals.

4. Estate Planning

Therefore, creating a financial legacy includes not just accumulation but protection and distribution according to one’s desire. The Estate Planning videos deal with wills, trusts, and beneficiaries: what it all means and how it affects the loved ones when one is no longer there.

5. Debt Management

It is often people who are worried about managing their debt, and hence videos on solutions regarding debt are extremely useful. From understanding credit scores to paying off loans and credit card debts, these videos extend a step-by-step guide in undertaking practical advice to reduce financial stress and common pitfalls that one falls into.

Benefits Developed Through Focused Wealth Management Videos

Videos can make a difference in how you achieve your financial goals. Here’s why:

1. Personalised Learning

You learn at your own pace because you can always replay sections for anything that might confuse you or even search for related videos in case you need further clarification.

2. Time Efficiency

Videos can compress information that would otherwise take hours to read or learn from somewhere else. It means a five-minute video can summarize the financial strategy that generally requires considerable research.

3. Visual Learning Support

Video content usually contains visuals that explain complex information. Compound interest, asset diversification, and risk assessment are some basic concepts that can be lucidly explained with the help of visuals.

4. Emotional Bonds and Everyday Scenarios

All the videos in another case of wealth management include real-life applications that make the content more relatable to life. The stories, shared mostly by a financial adviser or an ordinary person, can bring financial advice to life and make the viewers see what certain strategies can do.

5. Engagement and retention

Videos can retain people longer, which often results in learned information staying with the person longer. Concepts about money become overwhelming; with video content, there is often a conversational tone and application that allows viewers to retain the information for a longer period.

Finding the Right Focused Wealth Management Videos for You

Not all videos work for the needs of everyone, so it is very important to select contents that meet the chosen objectives in a given exercise. Here are some pointers on how to find videos that would provide maximum benefit:

1. Identify your financial priorities

Knowing what you want to learn—be it the basics of investing, planning for retirement, or managing debts—will narrow the options.

2. Check Credibility

Search for videos from trusted sources, which include certified financial planners, seasoned financial advisors, and reputable financial institutions. Most professionals will identify themselves with their qualifications to make it easy to know you’re getting reliable advice.

3. Please put more focus on content rather than on production quality.

As great as high-value video production may be, it’s ultimately information that proves to be deciding. Well-researched material, well-presented, and coinciding with your financial goals, is what you should aim for.

4. Viewers’ comments

Comments and reviews can even give context about the accuracy and usefulness of a video. Other times feedback on the video gives you insight into pieces of the content that you may have overlooked.

5. Follow the trends, and look at the updates.

The realm of finance is constantly changing, so finding channels or creators that update the content on it regularly will prove most helpful toward the goal of keeping yourself informed. Changes in the economy, tax law changes, and new investment opportunities are all things that could affect your financial plan, and you should be current about them.

Introduction to focused money management videos

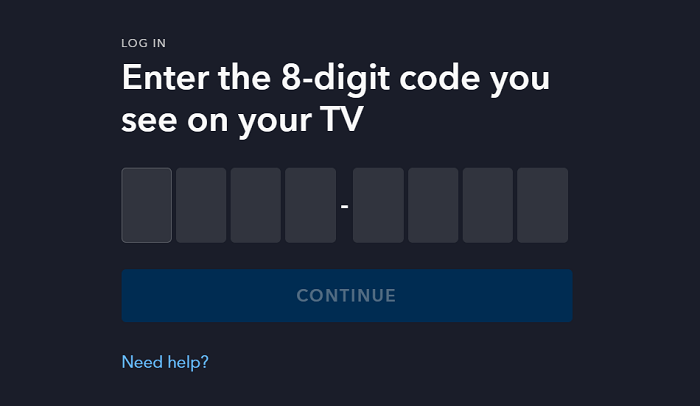

If you are ready to begin watching these videos, here is how you’ll get the most out of your learning experience.

- Set clear goals: First, clearly write down your financial objectives before you begin and use those as a guide in filtering the content that you will watch.

- Take Notes: Much like taking notes in a live setting, especially while videos offer clear-cut step-by-step directions, this will help solidify the information learned.

- Practice what you learn: Actually, try using the information given in your own financial life. If it was a video on budgeting strategies, try to set up a simple budget or assess your spending habits using those methods.

- Discuss and Share: Sometimes sharing what you learn with friends or family can solidify your understanding and help someone else too.

Conclusion

Why Focused Wealth Management Videos Are Here to Stay The demand for clear-cut, straightforwardly understandable financial advice has driven the popularity of wealth management videos that are laser-focused. They avail equal opportunity for any person of whatever background or level of financial literacy to get useful financial information. Thus, they are ideal for anyone intent on handling one’s wealth with a lot of minimal fuss because the conversation tone is endearing in both format and approach. There’s so much here that you really can’t go wrong-something in here directly speaks to your needs and financial goals.

Get expert tips and financial guidance at LookMyFinance.com